Policy administration allows carriers to manage the full lifecycle of all product lines. In 2020 and beyond, solution carriers have a keen eye on the transformation of carriers’ needs.

In this three part series, WaterStreet Company investigates the goals and priorities of insurance carriers today and the advanced technology they require. If you haven’t already, check out Part 1: The Future of Insurance Software.

Key Statistics on the Future of Policy Administration

WaterStreet Company surveyed an audience of 100 c-suite, director and vice president titled insurance professionals, ranging from companies in size between 201 and 5,000 employees.

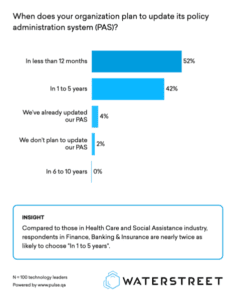

- 52% of tech executives at insurance carriers plan to update their policy administration system (PAS) in less than 12 months.

- There is a close tie between those who will internally manage PAS updates (43%) and those who will choose third-party consultants and system integrators (40%).

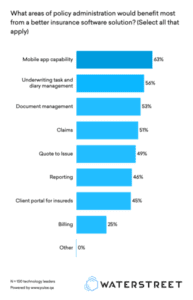

- 63% of tech executives believe mobile app compatibility could benefit their policy administration.

Download the full report, or continue reading for a summary of key statistics from the report.

Upgrading Policy Administration

Carriers today are finding policyholders require unique coverage for modern lifestyles. Many policy administration systems fall behind in their abilities to quickly add new product lines due to complex architecture.

We found 52% of tech executives plan to update their policy administration system in less than 12 months, followed by 42% in one to five years. Another 4% have already updated their policy administration system accordingly, and just 2% do not plan to update their policy administration system.

Not every policy administration system is created equal. As the need to expand product lines has evolved, many policy administration systems have not.

This conflict is in part due to internal resources. If the solution can manage standard policies and support the company’s bottom line, the push to expand new policies may be delayed through cost-centered concerns for the solution.

Today, many carriers are realizing long-term market positions and are much faster to react to solution updates. This calls for attention to internal IT departments, investments in the solutions’ architecture, and many internal conversations to identify exactly how to invest in the solution to meet current and future goals.

Who Will Manage the PAS?

The rise of Software as a Service (SaaS) has expanded many possibilities for carriers and MGAs.

We found 43% of respondents will continue to rely on their internal IT team to manage their policy administration over the next 10 years while 40% will rely on third-party consultants and system integrators. Another 17% plan to rely on low code or no code self service tools for end users.

The divide between internal or external resources to manage the policy administration system is close. This question ultimately comes down to whether the internal team is capable of seeing the company through the transformation with confidence that the solution will hold up for years after.

Many carriers are also switching towards cloud insurance software in order to keep up with long-term shifts. Cloud solutions reduce heavy burdens on internal IT teams, allowing faster updates in a cloud architecture and integrations with third-party solutions to help build the policies of tomorrow.

Benefits of Improved Policy Administration

Policy administration is the crux of the company’s process, and many areas of the business must connect to reduce bottlenecks and unnecessary manual labor. We asked tech executives to select all features that would benefit their policy administration system.

We found 63% of tech executives believe mobile app capabilities would benefit policy administration. Another 56% believe underwriting task and diary management, 51% believe claims integration, 49% believe quote to issue features, 46% believe reporting features, 45% believe client-facing portals for the insured and 25% believe billing integration.

A focus on mobile capabilities can often place heavy burdens on IT departments. Many carriers are moving towards Progressive Web Apps to lessen this burden, allowing developers to update both the company’s site and mobile app at once.

About WaterStreet Company

WaterStreet Company is dedicated to serving all facets of the Property & Casualty Insurance Sector. We understand the importance for carriers and MGAs to adapt to market changes.

Join us in following today’s most impactful trends on the P&C industry in this three part series and download the full infographic to learn more.

Reach out to WaterStreet Company today to request a consultation and demo of our solutions.