Insurance software has made tremendous strides to keep up with a shifting insurance industry.

In this three part series, WaterStreet Company investigates the goals and priorities of insurance carriers today and the advanced technology they require.

WaterStreet Company is here to help inform insurers of ongoing P&C insurance industry trends. We are a provider of P&C Policy Administration Software, supporting insurers through policy and claims administration, document management, third-party connections and much more.

Key Statistics on the Future of Insurance

WaterStreet Company surveyed an audience of 100 c-suite, director and vice president titled insurance professionals, ranging from companies in size between 201 and 5,000 employees.

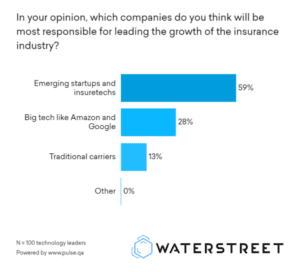

- 59% of respondents believe emerging startups and insurtechs will lead growth for the insurance industry.

- 47% believe the viability of AI, machine learning and blockchain are the most impactful trends on the P&C insurance industry today.

- 41% believe highly accurate risk mitigation and prevention of claims is the most likely profitable growth driver.

Download the full report, or continue reading for a summary of key statistics from the report.

A Digital Future for Insurance

The insurance industry is divided into traditional carriers, big tech carriers and emerging startups. The P&C insurance sector alone contains 2,509 carriers as of 2020.

We found 59% of respondents believe emerging startups and insurtech companies will be most responsible for leading the growth of the insurance industry. Another 28% believed big tech insurers, such as Amazon and Google, will lead growth, and just 13% believe traditional carriers will lead growth.

These findings come at little surprise. As we approached 2020, the insurance sector turned towards a hard market. Marked by firming rates, heightened premiums and a reduction in product offerings, insurers are now rebounding with all-new offerings and close attention to supportive software for transitioning into a more accessible digital age.

These findings come at little surprise. As we approached 2020, the insurance sector turned towards a hard market. Marked by firming rates, heightened premiums and a reduction in product offerings, insurers are now rebounding with all-new offerings and close attention to supportive software for transitioning into a more accessible digital age.

The pandemic has also left a strong impression on policyholders. Consumers today are seeking ways to reduce monthly payments while comparing insurance carriers, often to match their gig economy lifestyles.

Insurers able to keep up with market changes through flexible technology and efficient processes in claims management have a strong advantage, causing many emerging carriers to build their technology infrastructure in the cloud and for traditional carriers to quickly transition towards cloud insurance software.

Most Impactful P&C Insurance Trends Today

The P&C insurance sector faces many trends underway. Policyholders today are unlike those of the past, requesting offerings to fit unique lifestyles, and carriers are making strides to improve profitability and stay relevant in today’s landscape. The highest priority is to support the future of the business by catering to the next generation of policyholders.

We found 47% of respondents believe the viability of technology such as AI, machine learning and blockchain are the most impactful trends for the P&C insurance industry. Another 25% believe chatbots for customer service, 16% believe specifically claims processing with machine learning, 9% believe telematics and IoT data, and just 3% believe direct to consumer interaction.

Artificial intelligence in claims management has gained particular attention over recent years. With the rise of unstructured data, the human resources needed to process claims has become a clear bottleneck. So long as employees are required to manually review claims data, such as images, written text, videos and audio, the time and costs spent in claims processing is a cost-sink to the business. With the rise of AI and machine learning, algorithms are able to learn to identify trends in unstructured claims data, reducing the amount of time it takes to resolve claims from days to minutes. These efficiencies in claims management save the company dramatic costs on time to resolve a claim, and quickly satisfies the policyholder with an easy process towards payout.

Chatbots and trends around a simple and fast insurance customer journey are also a top priority for insurers today. Progressive Web Apps have the ability to unify the customer experience across desktop and mobile devices, reducing the company’s needs for webmaster and development resources, and simplifying the customer’s experience when interacting with the company. PWAs act as both mobile apps and desktop-accessible websites, allowing many possibilities for improvement to chat services and additional consumer-facing benefits.

Key Growth Drivers for P&C Insurance Carriers

While policyholders set higher standards for the policies they require, carriers are faced with the decision of implementing improvements to offerings and processes based on profitability.

We found 41% of respondents believe highly accurate risk mitigation and prevention of claims is the most likely profitable growth driver for insurance businesses. Another 31% believe offering more relevant types of insurance products and coverage, 22% believe process automation and efficiencies, 4% updates to existing products to fit current market needs, 1% new customer experiences and 1% usage-based insurance.

One of the underlying factors towards improved risk mitigation is the use of Internet of Things (IoT) data. The combination of lower costs for sensor hardware and cloud solutions have allowed homeowners and vehicle owners to track the most important data relevant to caring for their property. Flood sensors for homes are quickly gaining traction, allowing homeowners to gain mobile notifications if a flood sensor indicates water in the home, and many apps take this a step further to allow homeowners to remotely turn off the home’s water supply in the case of a water leak. Many carriers either offer discounts or are considering offering discounts for homeowners who show an advanced level of risk mitigation, as this can greatly reduce the cost of a claim down the line.

The products requested from carriers today are very unique and modern. Policyholders who own vehicles are understanding the value of ride sharing. Homeowners with vacation homes are considering AirBnB renting to easily gain profit on their second homes. The policies needed to cater to this audience call for unique liability. The rise of self-driving cars has just begun, and is here to stay, placing liability on the manufacturer rather than the driver. Embedded insurance, which is insurance coverage offered at the point of sale on an asset or property, has also gained traction.

About WaterStreet Company

WaterStreet Company is dedicated to serving all facets of the Property & Casualty Insurance Sector. We understand the importance for carriers and MGAs to adapt to market changes.

Join us in following today’s most impactful trends on the P&C industry in this three part series.

Reach out to WaterStreet Company today to request a consultation and demo of our solutions.