Loss triangles are among the most important and trickiest forms of reporting in the insurance industry. Insurance experts aim to use loss triangles to predict the company’s periodic losses to the most accurate possible figure, serving to support expense reserves.

Actuaries and financial executives regularly conduct loss triangle analysis in compliance with Statutory Quarterly and Annual Statements. Over any given period of time during loss triangle analysis, it may take several years for all claims in a given policy period to be reported and closed, impacting the total loss long after the end of a policy period, calling for advanced practices to reach the most accurate results.

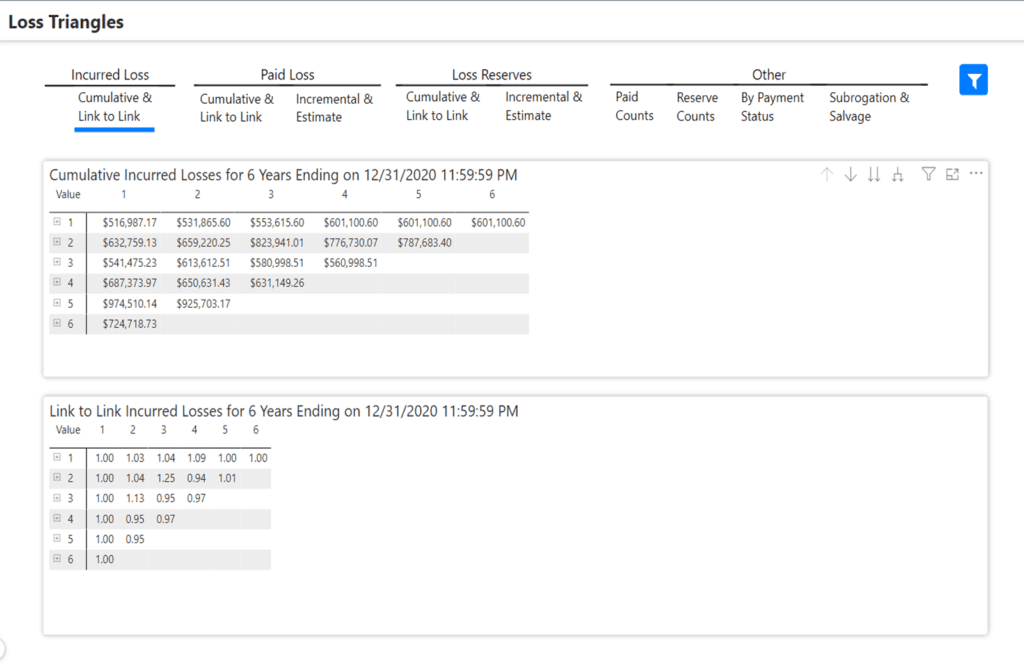

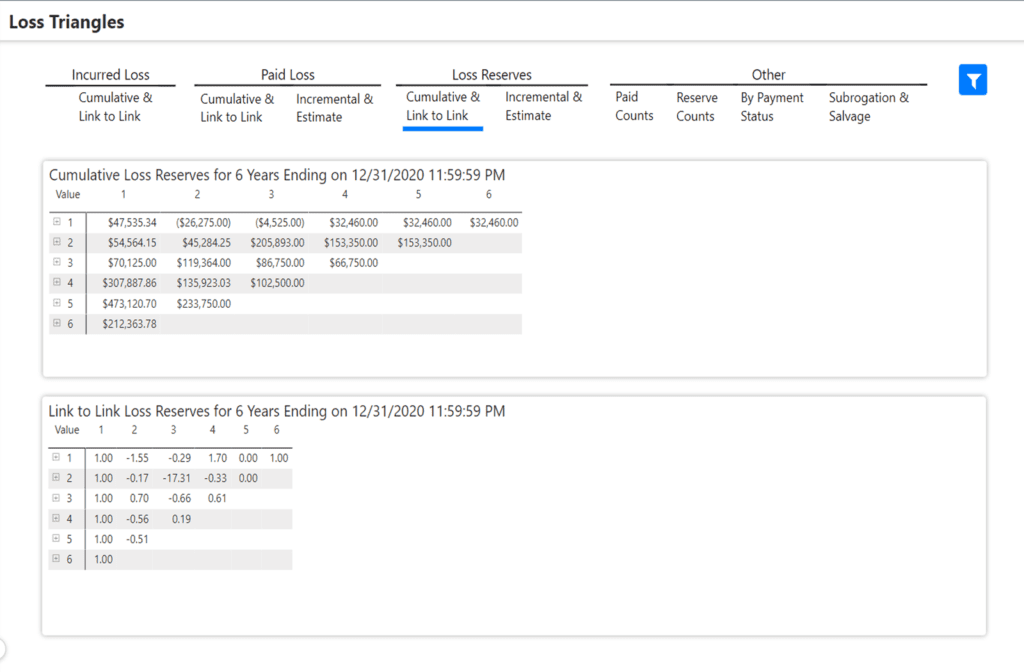

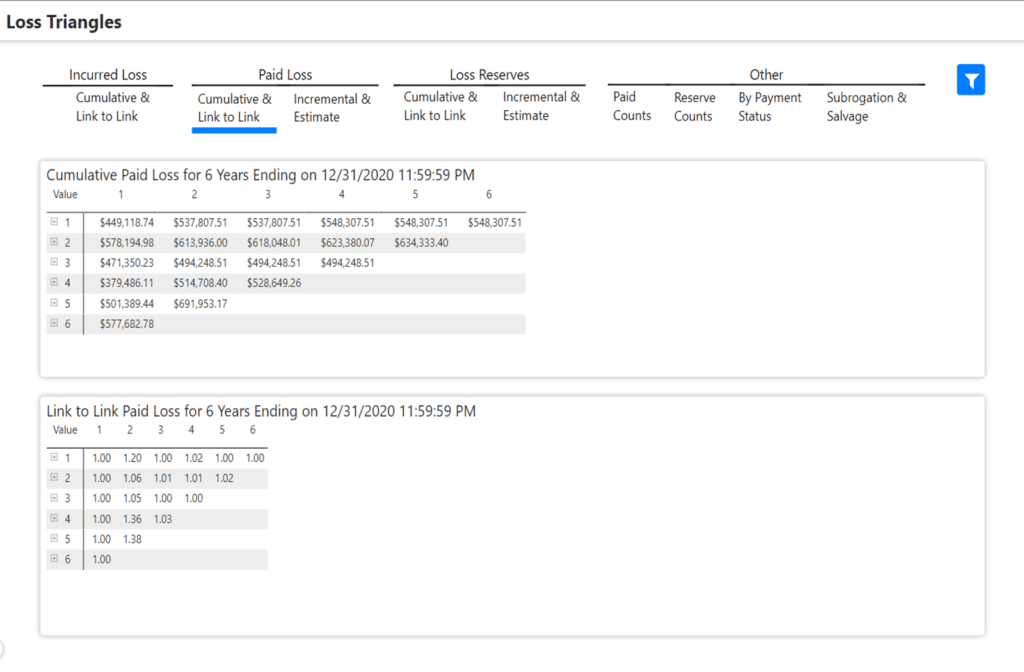

WaterStreet Company makes it easier to review and compare key information for loss triangles with our Business Intelligence Suite, including:

- Identify claims and claim costs over time.

- Predict where losses are going based on the past data.

- Filter based on catastrophic vs non-catastrophic losses, losses by line of business, and other loss causes.

- Provide estimates of ultimate loss to reflect on an organization’s financial statements.

- Switch between Accident Period and Schedule P.

- Gain a snapshot of summarized evaluation of losses periodically to maintain a picture of losses.

- The development in losses is the quantitative change in loss triangle evaluation from year to year.

Loss Triangle Analysis

“With WaterStreet’s Business Intelligence Suite, every user becomes an instant analyst, gaining efficiencies with automation in day-to-day reporting processes as well as improving overall decision-making with reliable data,” – Kelly King, CFO, WaterStreet Company.

What is the purpose of a loss triangle?

Loss triangles are used by actuaries and financial executives to project and predict the ultimate number and amount of losses as indemnity and loss adjustment expenses for each accident year. This analysis is completed in order to properly estimate total loss and loss adjustment expense reserves for financial reporting purposes. Analyzing and providing estimates by accident year offers the clearest evidence supporting the company’s total reserves recording on financial statements.

Why are loss triangles difficult to complete?

Loss triangles can be described as an esoteric and elusive exercise as most experts outside of the actuarial profession do not have the training or learning experiences to complete the analysis. Staff with the understanding of how to properly construct loss triangles, especially those that must comply with Statutory Annual and Quarterly Statement presentations, have historically been essential for meaningful analysis.

What is the most efficient way to evaluate a loss triangle?

One of the most common issues when conducting loss triangle analysis is when “claims” or “loss” data is not stored in a well-organized database. The data may also be maintained by a Third Party Administrator. Collecting and organizing the data for inclusion in loss triangles can be a time consuming process, and in the end, there may be concern as to the integrity of the data due to the data collection process. WaterStreet Company’s Business Intelligence Suite ensures actuaries and CFOs have direct access to all claims data for a simpler, more visual review, while ensuring the integrity of the data.

What are the most common missed opportunities when conducting loss triangle analysis?

It’s important to note there are required triangles for Statutory reporting, but analysis of many claim components at more granular levels can be accounted for in the loss triangle analysis. This can lead to many more insightful observations and conclusions that could affect reserving practices, pricing decisions, claims workflow processes, and more. If this data is difficult to assemble and infrequently considered, it is a high missed opportunity for a data-driven management team.

WaterStreet Company & Loss Triangles

WaterStreet Company aims to deliver best-in-class solutions for P&C insurers. This year, we’ve launched our Business Intelligence Suite to help insurers track vital key performance indicators specific to the insurance industry.

We provide advanced P&C Insurance Software designed to grow with your business, allowing integration with next-generation solutions.

Ready to Take Action?

Reach out to WaterStreet Company today to request a consultation and demo of our solutions.