Insurance experts have to keep a keen eye on renewal retention rates as maintaining these rates ensures recurring revenue and predictability in revenue. A high renewal retention rate secures the company’s “keys to the kingdom” in the insurance market and provides longevity for the business.

Marketing Vice Presidents, marketing representatives and agencies have interest in tracking renewal retention rates, taking action on these figures to support a predictable base of policyholders for the insurance company.

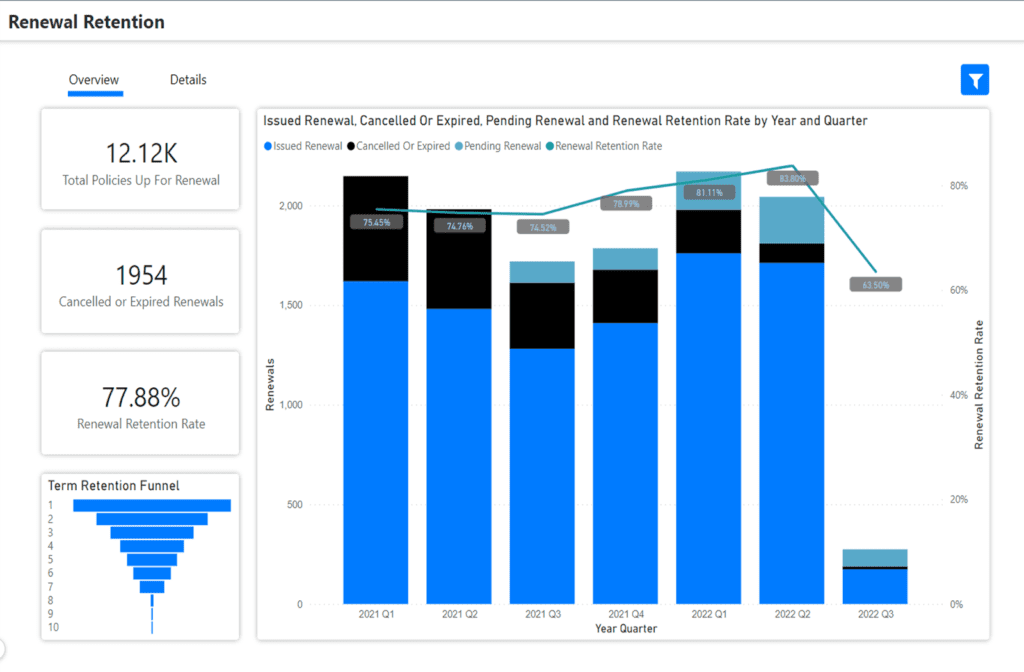

WaterStreet Company makes it easy to review and compare key information for renewal retention rates with our Business Intelligence Suite, including:

- Track renewal retention rates over time to see if they are stable, increasing or decreasing.

- Track target retention rates.

- Compare date ranges by year, quarter and month.

Renewal & Retention Analytics

“With WaterStreet’s Business Intelligence Suite, every user becomes an instant analyst, gaining efficiencies with automation in day-to-day reporting processes as well as improving overall decision-making with reliable data,” – Kelly King, CFO, WaterStreet Company.

Why are renewal retention rates important?

Renewal retention rate is the inverse to lapse rate. It is a highly important KPI to prove recurring revenue, which essentially means the company doesn’t start from zero revenue each year. The company has a predictable base of policyholders upon which to rely for revenue as the company continues to grow.

A high retention rate may prove one or more of the following:

- Rates are competitive.

- The company’s policies and rates, in combination, are accepted in the market by agents and insureds.

- Customer service for both policy and claims servicing is appreciated by the insured and agents.

- There are not excessive, or “low-balling,” competitors poaching the business.

- There may be a certain overall stability to your market and the company’s product line that produces high retention rates.

- The company has not implemented new, higher premium rates when compared to competitors.

- The company has not made underwriting more restrictive, such that the company did not intentionally or unintentionally drive down renewal retention rates or new business rates.

What actions can be taken to improve renewal retention rates?

Marketing experts and agencies can review rates and underwriting rules to ensure when downward movements in retention rates were intentional. The team should also complete a review to prove the lapsed policies in a given period were the ones the company did not want to renew.

It’s important to review rates and underwriting rules to find ways to better retain your customers. Consider customer service standards and practices, both in policy and claims servicing, to find areas of improvement, and make those improvements.

Ensure your agency and policyholder messaging and communications invite insureds and agents to want to stay with you, both for your financial stability (claims paying ability) and your excellent service, especially when claims arise. Also ensure agents and other policy systems users have an excellent workflow experience, such that there is no friction in the system preventing the issuance of new or renewal business.

WaterStreet Company & Renewal Retention

WaterStreet Company aims to deliver best-in-class solutions for P&C insurers. This year, we’ve launched our Business Intelligence Suite to help insurers track vital key performance indicators specific to the insurance industry.

We provide advanced P&C Insurance Software designed to grow with your business, allowing integration with next-generation solutions.

Ready to Take Action?

Reach out to WaterStreet Company today to request a consultation and demo of our solutions.