Earned premium is an essential benchmark for both Statutory statements and routine actuarial analysis. Analysis of earned premium can improve rate making and allows experts to drill down into which policies need attention for profitability.

Insurance executives, actuaries and accounting managers have interest in periodically reviewing earned premium. A review of Earned Premium can lead to many new insights and improvements from the loss ratio to underwriting.

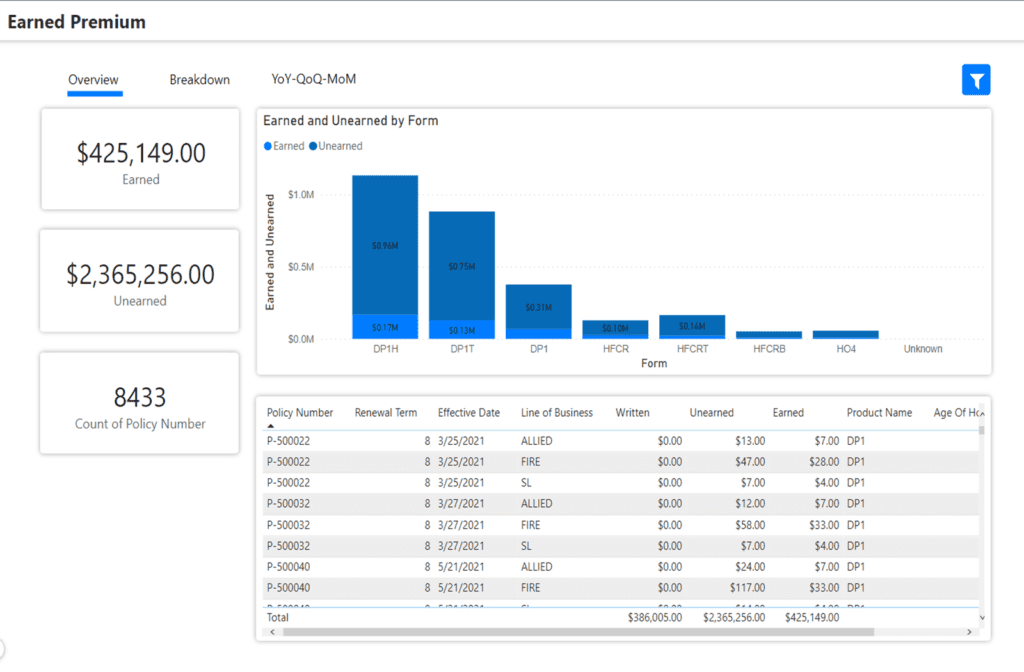

WaterStreet Company makes it easy to review and compare key information about earned premium with our Business Intelligence Suite, including:

- Save tremendous time in accounting with quick insights into financials and to understand where revenue is coming from.

- Gain simple overviews into earned vs unearned premiums.

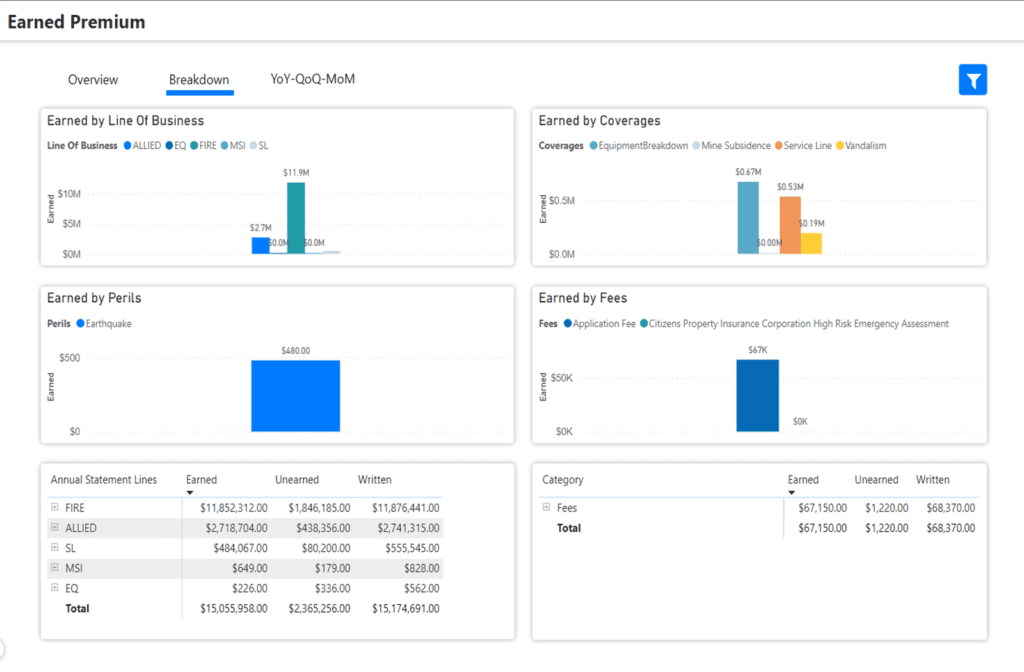

- Discover breakdowns of earned premiums by statement lines, coverages, perils and fees.

- Take record at summary levels for lines of business for the following:

- As a standard statutory determinate

- Monitor product levels to help manage the business

- Monitor state levels to view the data by various states.

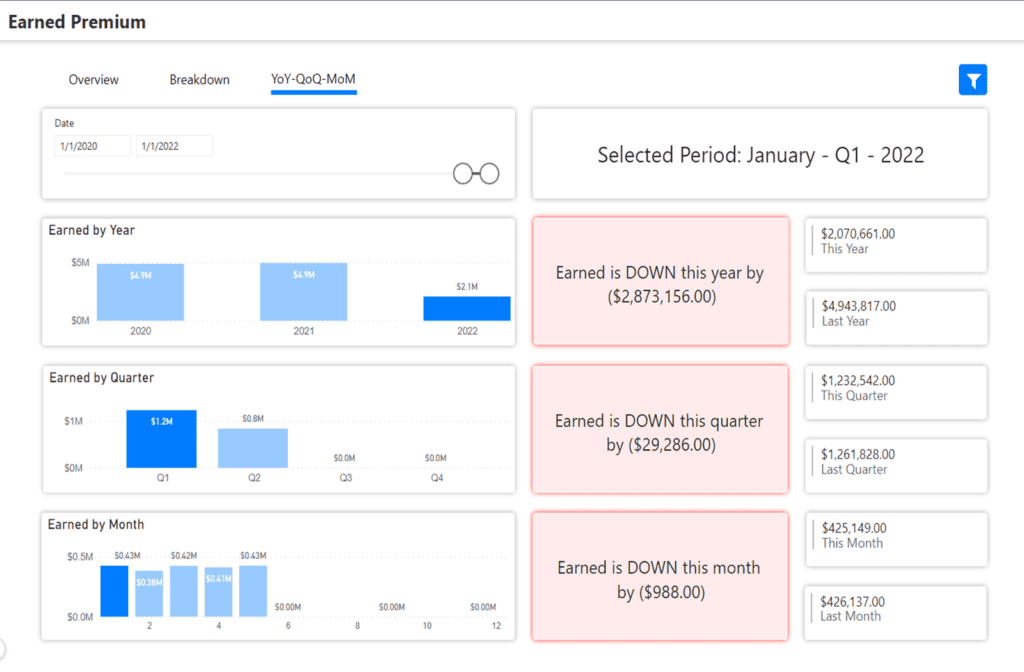

- Track goals and growth over time and identify yearly, quarterly and monthly trends.

Earned Premium Analytics

“With WaterStreet’s Business Intelligence Suite, every user becomes an instant analyst, gaining efficiencies with automation in day-to-day reporting processes as well as improving overall decision-making with reliable data,” – Kelly King, CFO, WaterStreet Company.

Why is it important to the business to review earned vs unearned premiums?

Earned Premium is the industry-accepted denominator in the calculation of a carrier’s Loss and Loss Adjustment Expense Ratio, also referred to as incurred losses and loss adjustment expenses by earned premium. This analysis defines the company’s basic loss ratio experience of all policies in force in an accounting period. Because it is an accounting measurement at a point in time, it is far more stable compared to unearned premium, taking the premiums earned in that time period for all policies in force at that time and charging loss payments and any changes to loss reserves against the broader definition of premium.

How does the Earned Premium report help with statutory reporting?

While Written Premium represents the entire policy premium reported in the month in which it became effective and issued, “Earned” Premium is how policy revenues are recognized in both Statutory and GAAP financial statements. Earned Premium represents the company’s top line revenue in any particular accounting period reported, whether by month, quarter or year. Generally, the policy premium is recognized ratably over the full term of the policy (most often one year.) For example, an annual policy of $1,000 will be earned ratably over twelve months, or approximately $83 per month.

Earned Premiums are the basis of actuarial analysis in rate making, not Written Premium. Actuaries are interested in the daily value over the full policy term and fitting losses and other expenses to that revenue. These comparisons then include endorsement and cancellation activity that occurs along the way, and can be compared across a trended number of policy terms to get the rates right for the changes occurring externally and internally over time.

What kinds of trends should I look for when reviewing Earned Premium?

A key trend to observe when reviewing Earned Premium is the average earned premium per policy. Ask:

- Is it going up or down?

- How does that affect the loss ratio?

- Is it the premium going up or down affecting the loss ratio, or are the losses increasing the loss ratio? If both, then why?

- What needs to be done with rates?

- Which coverages may need rate adjustment?

- Will adjusting deductibles or coverage limits and sub-limits be the solution?

- What needs to be done with underwriting to quell certain kinds of claims, or is it our claims settlement process that could be a partial cause?

WaterStreet Company & Earned Premium Analytics

WaterStreet Company aims to deliver best-in-class solutions for P&C insurers. This year, we’ve launched our Business Intelligence Suite to help insurers track vital key performance indicators specific to the insurance industry.

We provide advanced P&C Insurance Software designed to grow with your business, allowing integration with next-generation solutions.

Ready to Take Action?

Reach out to WaterStreet Company today to request a consultation and demo of our solutions.