Measuring direct premiums gives insurers a clear look at where revenue is coming from. This type of reporting is required and highly useful in many areas of business planning for an insurer.

Insurance executives and accountants commonly review written premiums, either to monitor growth benchmarks or for statutory financial statements.

WaterStreet Company makes it easy to review written premium data with our Business Intelligence Suite, including:

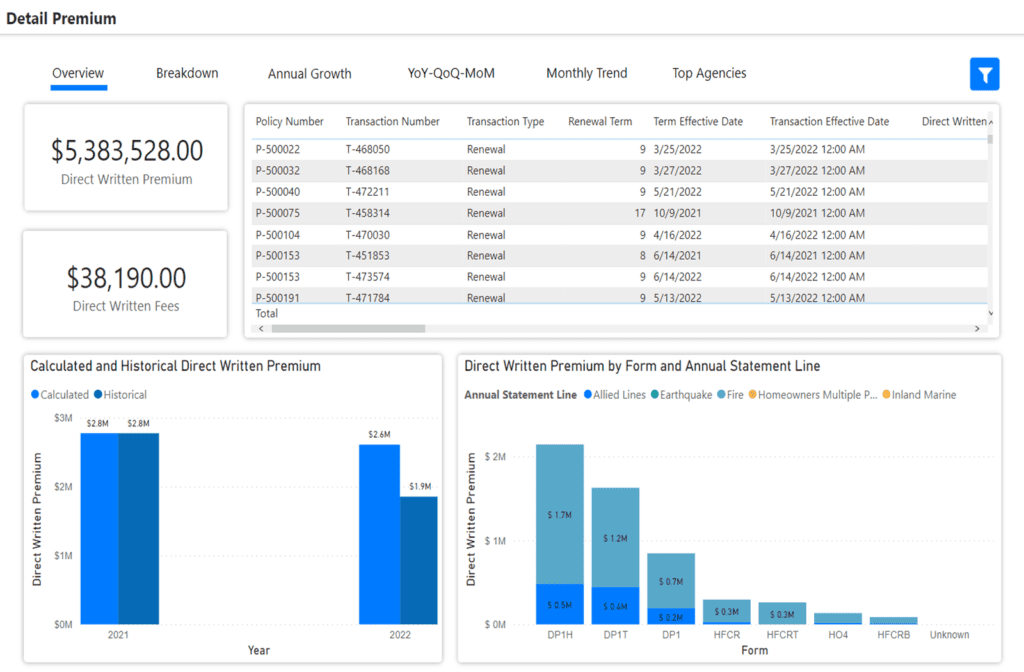

- Generate a report with detailed analysis of Written Premium for all transactions in force for date ranges selected.

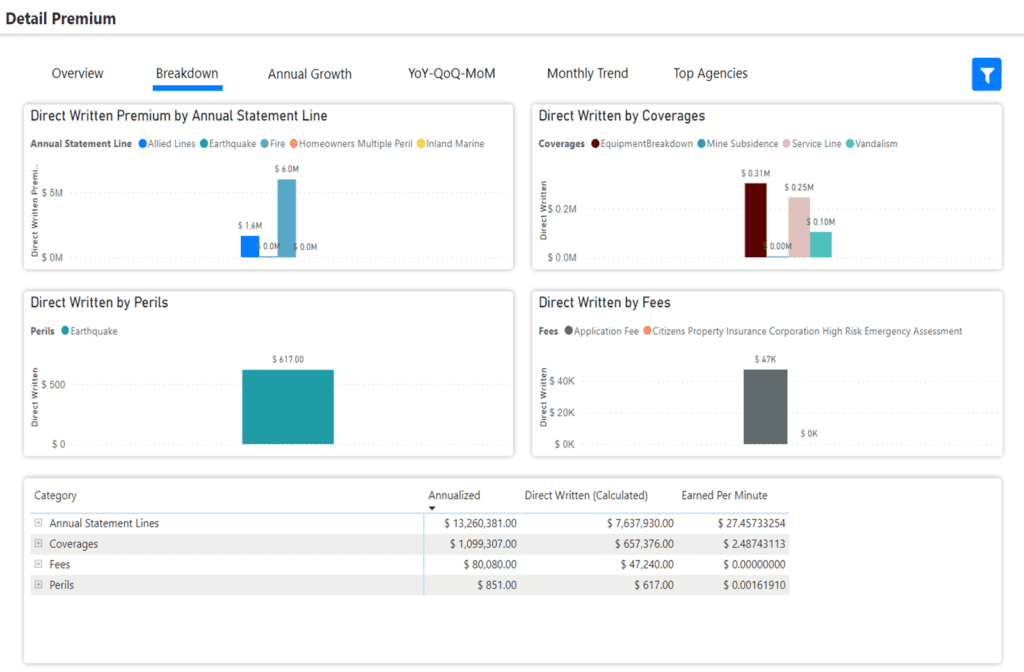

- Easily breakdown and subtotal specific items, including direct premiums at the state level and product level.

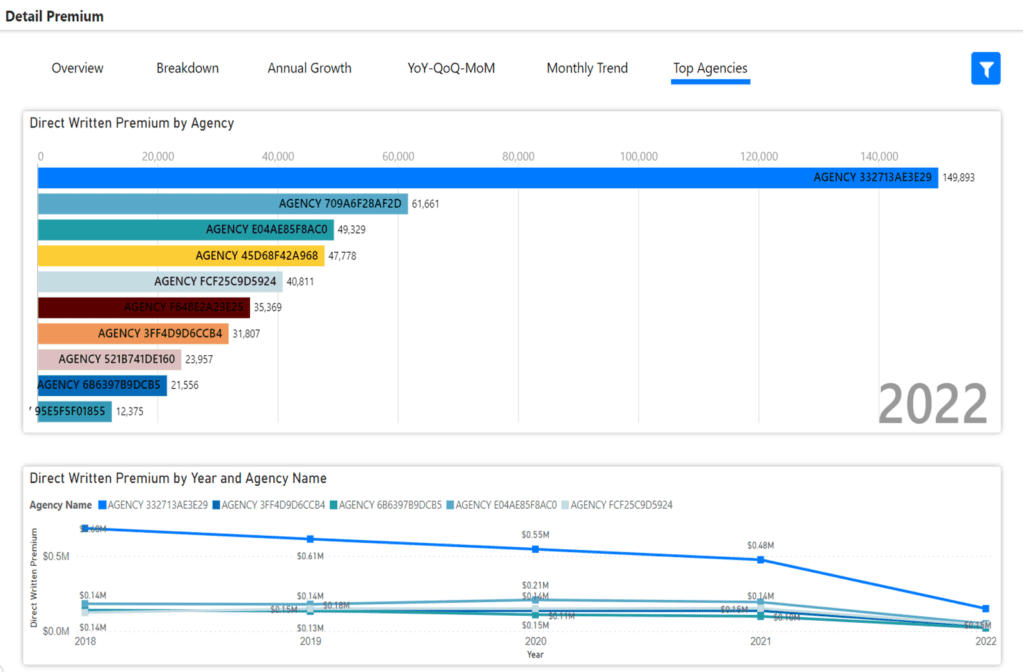

- Identify where revenue is coming from in premiums.

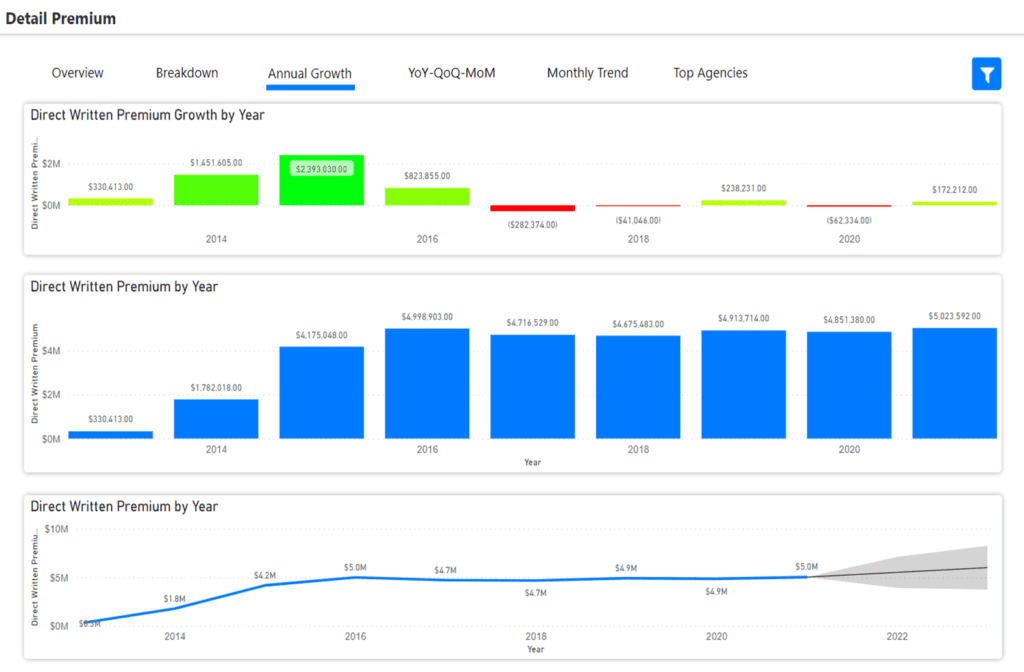

- Review seasonality in the Annual Growth Tab.

- Track goals over time and trends in premiums.

- Measure retention under the Monthly Trend tab.

- Analyze how new business and renewals drive revenue per accounting period.

- View a whole 12 months of data for annual trends.

Detail Premium Analytics

“With WaterStreet’s Business Intelligence Suite, every user becomes an instant analyst, gaining efficiencies with automation in day-to-day reporting processes as well as improving overall decision-making with reliable data,” – Kelly King, CFO, WaterStreet Company.

How does reviewing Detail Premiums help to support my monthly financial reporting and statutory reporting?

The Detail Premium report is used to analyze the company’s Direct Written Premiums. The National Association Of Insurance Commissioners (NAIC) requires accounting of designated premiums reported in all statutory financial statements. This reporting represents all new and renewal policy premiums written in a given accounting period, whether by month, quarter or annual, as well as adjustments to in force premiums for endorsement and cancellation activity.

It is highly useful to analyze direct written premium trends for any periods of interest. It is important to know that your analysis of such direct written premiums is consistent with statutory accounting rules.

How does reviewing Detail Premiums help to reconcile commission expenses and earned premiums?

Most agency commission arrangements are based on direct written premium and sometimes earned premium. The commission rate is typically applied to the direct written premium or direct earned premium. Therefore, a reconcilement of total commissions calculated to total premiums written or earned can assist in verifying month end commission expenses.

How can I spot seasonality when reviewing premium data?

Trend analysis can identify your seasonality when reviewing premium data, whether quarterly or annually. Trend analysis is useful to identify seasonality for highs and lows in production volumes. This may be helpful in budgeting, staffing, cash flow planning, future projections and more.

WaterStreet Company & Written Premium Analytics

WaterStreet Company aims to deliver best-in-class solutions for P&C insurers. This year, we’ve launched our Business Intelligence Suite to help insurers track vital key performance indicators specific to the insurance industry.

We provide advanced P&C Insurance Software designed to grow with your business, allowing integration with next-generation solutions.

Ready to Take Action?

Reach out to WaterStreet Company today to request a consultation and demo of our solutions.