Why are policyholders canceling? Insurers can find a wealth of knowledge behind the reasons for cancellations while meeting regulatory compliance.

Operations managers, product managers and division managers have reason to dig into why policies are being canceled. Uncovering trends behind cancellations can uncover better practices across the company.

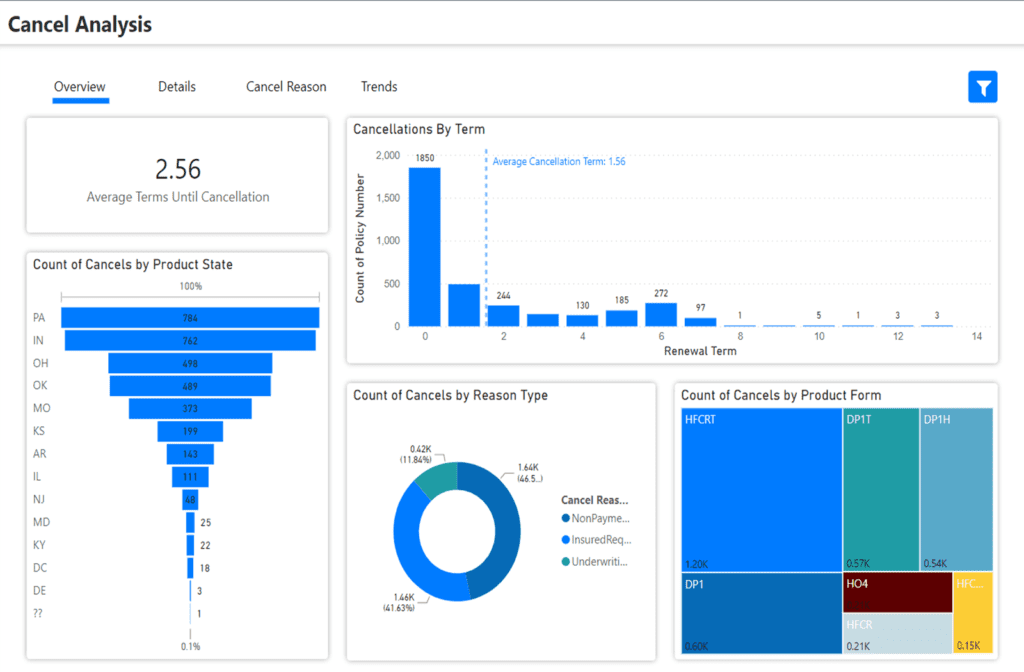

WaterStreet Company makes it easy to review and compare key information about cancel analysis with our Business Intelligence Suite, including:

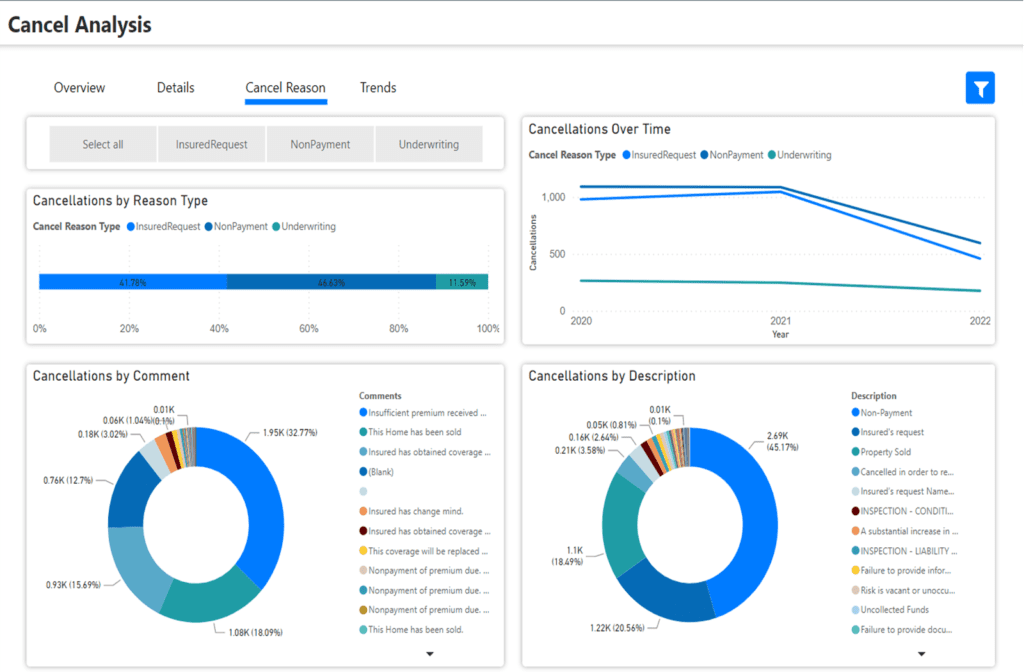

- Analyze the reasons policies are being canceled.

- Find patterns in cancellations that may occur with underwriting activity, customer activity, nonpayment, or coverage replaced.

- Identify trends in premiums.

- Meet regulatory compliance for information requests regarding the company’s operations and frequency for canceled coverage that was bound and premium collected.

- Identify policies allowed to be canceled during the underwriting period.

- Identify when too many unacceptable risks have been bound and then rejected by underwriting.

Policy Cancellation Analytics

“With WaterStreet’s Business Intelligence Suite, every user becomes an instant analyst, gaining efficiencies with automation in day-to-day reporting processes as well as improving overall decision-making with reliable data,” – Kelly King, CFO, WaterStreet Company.

How do I find trends in policy cancellations and what are the most common reasons?

There are many trends to watch for in policy cancellations. We have a few of the most common detailed below:

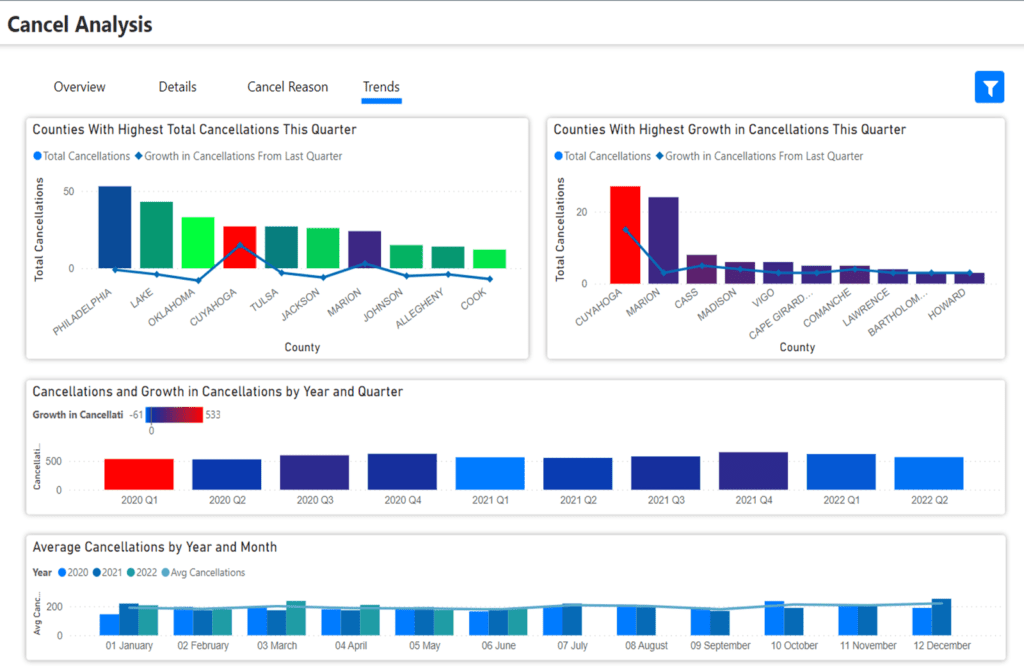

- Often, an insurer can find excessive cancellations by a specific agency. This is a great starting point to finding the reason for these unusually high cancellations.

- There may also be excessive cancellations in a particular territory. This could lead to a few notable trends, such as cancellations through a specific agent. There may also be a competitor within a certain territory, pulling agents away from your own business. Is the company being perceived to have a financial problem and agents are recommending others? Zeroing in on territories can lead to deeper analysis.

- Consider why there might be a spike in a particular reason for cancellations. This could be caused by nonpayment of installments. Managers can catch at which installment stage cancellations are happening.

Managers can also review cancellations to make sure trends are in normal range. Reasons for cancels make sense within a standard context, such as “Insured request – they have moved.”

Is cancel analysis required for regulatory compliance?

Regulatory Market Conduct Exams occur where cancellation frequency, as a percentage of total In Force, is tested. If you experience very high, and thus, abnormal cancellation rates for a particular line of business, the regulator may ask for further details and explanations. The Cancel Analysis report greatly simplifies that research to meet regulatory compliance.

How can we better prevent policies from being rejected during underwriting?

A wide statistical review of cancellations should be conducted from time to time to determine if there are things within the underwriting and agency management disciplines that could be changed based on observations made from cancel analysis.

WaterStreet Company & Cancel Analysis

WaterStreet Company aims to deliver best-in-class solutions for P&C insurers. This year, we’ve launched our Business Intelligence Suite to help insurers track vital key performance indicators specific to the insurance industry.

We provide advanced P&C Insurance Software designed to grow with your business, allowing integration with next-generation solutions.

Ready to Take Action?

Reach out to WaterStreet Company today to request a consultation and demo of our solutions.