Transformation for the insurance industry depends on many tech leaders and the products under development.

In this three part series, WaterStreet Company investigates the goals and priorities of insurance carriers today and the advanced technology they require. Read Part 1: The Future of Insurance Software and Part 2: The Future of Policy Administration.

Key Statistics on the Future of Insurance Products

WaterStreet Company surveyed an audience of 100 c-suite, director and vice president titled insurance professionals, ranging from companies in size between 201 and 5,000 employees.

- Intuitive user interface design is the number one characteristic tech executives at insurance carriers look for.

- 65% of surveyed tech executives require 3-6 months to design, test and deploy a new insurance product.

- 45% of tech executives believe more robust customer support is the best way to alleviate the pain associated with new systems and deploying new products.

- 80% of tech leaders at insurance carriers believe digital payment solutions will be one of the most important integrations and innovations over the next five years.

Download the full report, or continue reading for a summary of key statistics from the report.

Characteristics of Future Solutions

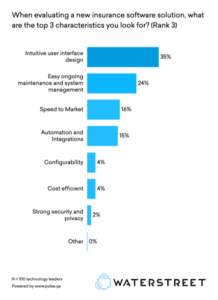

What do insurance carriers look for when evaluating a new insurance software solution?

We found 35% of insurance tech leaders look for intuitive user interface designs. Another 24% look for easy ongoing maintenance and system management, 16% look for speed to market, 15% look for automation and integrations, 4% look for configurability, 4% look for cost efficiency, and 2% look for strong security and privacy.

As many tech-reliant companies know, your technology is only as good as the people who use them. It’s vital to company processes that employees have access to intuitive user interfaces to get the job done.

Easy ongoing maintenance for today’s software solutions has become among the highest priorities as well. Over the past decade, many carriers became stuck with legacy solutions that were unable to update due to complex architecture and rigid rules systems. Solutions of tomorrow remove these roadblocks in cloud environments.

Timeline for Deploying Products

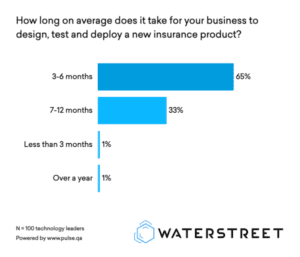

Accelerated market changes call for fast deployment of products. How long does it take carriers to deploy new products?

We found 65% of carriers require 3-6 months to deploy new products. Another 33% require 7-12 months, and just 1% can either deploy in under 3 months or require over a year.

Fast product deployment is an ongoing challenge for many carriers and insurance technologies. Policyholders today require unique products to fit gig economy lifestyles, smart homes, and unique locations at risk of perils.

As carriers review new methods of risk segmentation and retire old product lines, research and development brings promise to all-new offerings to support the company’s bottom line.

Pain Points In Product Launch

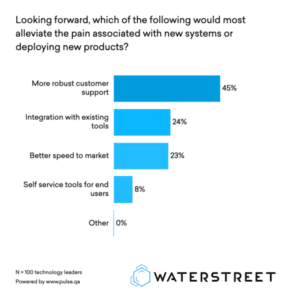

Modern Policy Administration Solutions aim to help carriers easily and efficiently deploy products.

We found 45% of tech leaders believe more robust customer support would alleviate pain associated with new systems or deploying products. Another 24% believe integration with existing tools, 23% believe better overall speed to market, and 8% believe self service tools for end users.

When carriers run into an issue while deploying or administering new products, it’s important to find support quickly. Solutions built in-house rely on an internal IT team that must shift focus to support solution issues, while solutions built in the cloud and through SaaS providers offer teams available to support clients with any sudden or ongoing issues.

Integration with existing tools is key. PAS solutions built with a robust Application Program Interfacing (API) give carriers the ability to connect to any number of third-party solutions, opening doors for the product development team.

Third-Party Integrations

Carriers today are looking ahead to establish stability in a rapidly changing environment. Third-party solutions can greatly impact carriers’ abilities to bring new data into their system.

We found 80% of tech leaders believe digital payment solutions are the most important third-party integrations to implement. 58% believe customer portal or phone applications, 56% believe fraud detection software, 47% believe comparative rating solutions, and 45% believe analytics solutions.

When solutions are built in a cloud architecture with a robust API, anything is possible. Digital payments are a common pain point for carriers that may not have a single, unified solution in the cloud. As the payment options policyholders request expands, such as with PayPal or cryptocurrency, carriers can choose to upgrade payment methods and other advanced features to schedule payments.

Customer portals also give policyholders more control over their policies. These portals offer customers access to all documents related to their coverage and can also serve as a contact point for placing claims or reaching customer service.

About WaterStreet Company

WaterStreet Company is dedicated to serving all facets of the Property & Casualty Insurance Sector. We understand the importance for carriers and MGAs to adapt to market changes.

Reach out to WaterStreet Company today to request a consultation and demo of our solutions.