Underwriting is among the most crucial areas of P&C insurance where efficiency and speed must be closely watched. Underwriting requires many unique approaches while finding trends in claims data and reviewing numerous documents, but must also follow a clear process and guidelines to run smoothly.

Executives, underwriters, product managers and other product-oriented roles have reason to stay in tune with underwriting speed, reviewing underwriting efficiency across product lines.

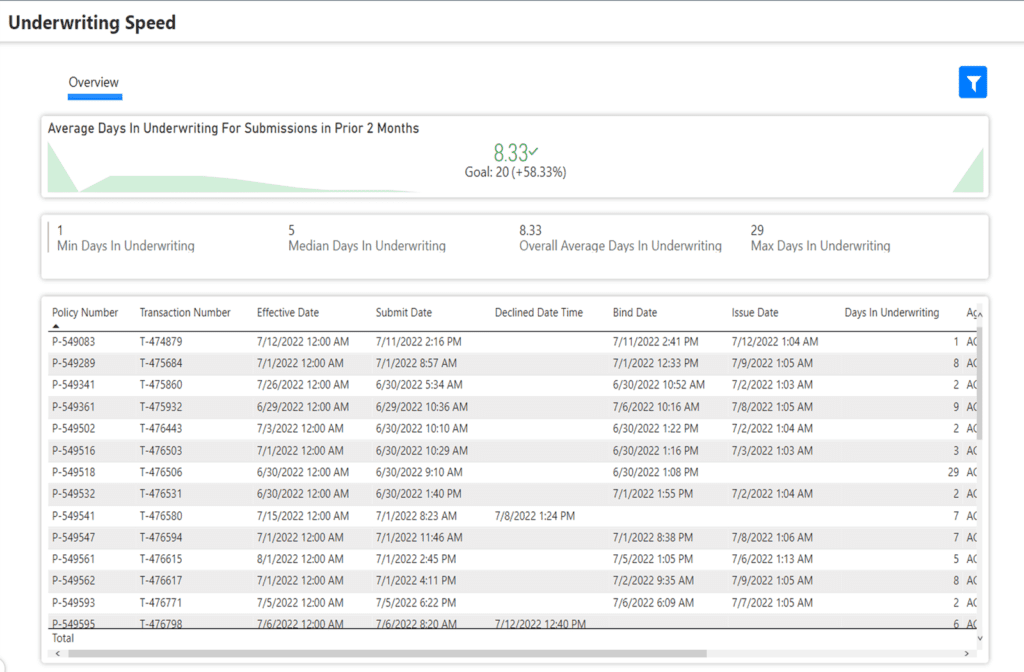

WaterStreet Company makes it easy to review and compare key information about underwriting efficiency with our Business Intelligence Suite, including:

- Review the average number of days a quoted policy spends in underwriting based on the initial submitted date.

- Easily identify KPIs through green or red indicators for when customized goals are or are not being met.

- Catch how often policies slip through the cracks and determine bottlenecks in the system.

Underwriting Speed Analytics

“With WaterStreet’s Business Intelligence Suite, every user becomes an instant analyst, gaining efficiencies with automation in day-to-day reporting processes as well as improving overall decision-making with reliable data,” – Kelly King, CFO, WaterStreet Company.

How long is the P&C industry average for the underwriting stage?

When it comes to underwriting speed, there is no clear answer to how long this stage requires as it varies by line of business. A homeowners policy or personal auto policy could take just minutes if all necessary information is entered for the underwriter. On the other hand, the process could take days if the carrier must retrieve information from the agent. If the policy is somewhat non-conforming, it may also take days for an underwriter to review and choose to accept or decline. Some sources indicate mortgages often require 30-45 days for full review including the underwriting stage within 72 hours.

What are the most common bottlenecks in underwriting?

The most common bottlenecks in underwriting are:

- Non-conforming policies that require unique underwriter review and approval.

- Delays in providing needed underwriting documents, such as inspection, certificates, pictures, or information on prior losses.

- Non-modern Policy Administration Systems that could be designed to create a streamlined process between the agent and the carrier.

Modern Policy Administration Systems (PAS) greatly streamline documents and communication for underwriters as well as provide advanced rule setting, error detection and reporting. When the company’s PAS connects to other departments through a unified solution, the P&C insurance ecosystem allows insurance experts to manage the full lifecycle of all product lines without the need for underwriters to work outside the system.

What are the most common ways to improve efficiency in underwriting?

Efficiency in underwriting can often be improved in the following ways:

- Set solid guidelines then make them easy to understand and implement. Monitor progress to ensure underwriters stay within the guidelines.

- Analyze the underwriting process and make changes to the Policy Administration System to improve areas of need.

- Have well trained and adequately staffed customer service and underwriting support teams.

How can I tell when more underwriter staffers are needed?

There are a few clear signs to consider when deciding if more underwriter staffing is required. A well-run carrier will have Service Level goals for all transaction cycles, including:

- New Business

- Renewals

- Endorsements

- Cancellations

If any of the Service Level goals for these transaction cycles are consistently unmet, it may likely be poor training, poor management, or understaffing.

When the carrier receives repeated complaints from producers/agents, it may be a sign more staffing is required.

Long delays between policy binding and policy issuance is also an indicator of either inefficiency or clear understaffing.

WaterStreet Company & Underwriting

WaterStreet Company aims to deliver best-in-class solutions for P&C insurers. This year, we’ve launched our Business Intelligence Suite to help insurers track vital key performance indicators specific to the insurance industry.

We provide advanced P&C Insurance Software designed to grow with your business, allowing integration with next-generation solutions.

Ready to Take Action?

Reach out to WaterStreet Company today to request a consultation and demo of our solutions.