When applications are outstanding, opportunities to secure business may be left on the table. It’s important to keep track of where applications are caught in the process to secure new customers. When a customer has made it through the quote stage and submitted an application, insurers must be sure to keep up with action items and bind the policy.

Underwriters, customer service managers and operations managers must stay on top of applications outstanding. All three roles can respond to applications that may have fallen through the cracks.

WaterStreet Company makes it easy to review and compare key information about applications outstanding with our Business Intelligence Suite, including:

- Inefficiencies in the quote to issue process.

- Tracking the average application outstanding rate to improve performance.

- Better inform staffing to support underwriting when applications are outstanding.

- Track the rate of growth for applications in process.

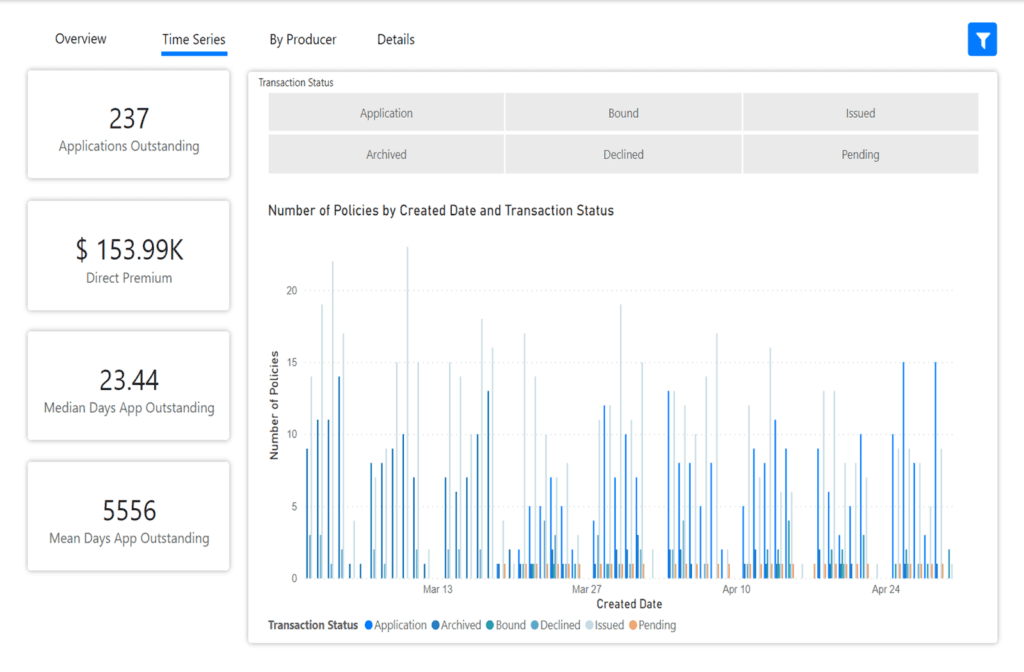

- Compare transaction statuses (quote, application, bind) over time.

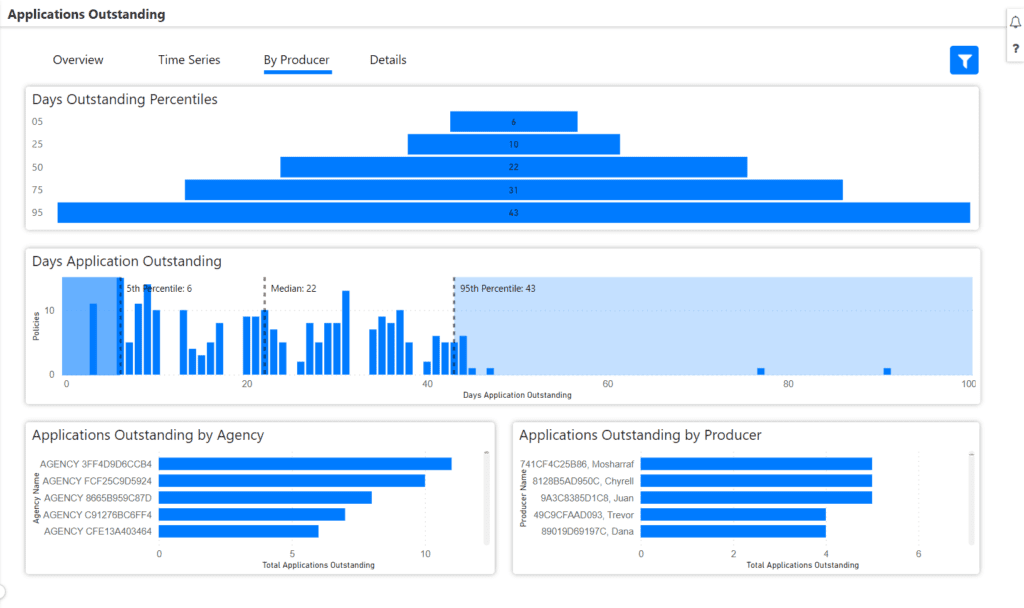

- Track days outstanding percentiles to trigger action items to address high percentages.

Applications Outstanding Analytics

“With WaterStreet’s Business Intelligence Suite, every user becomes an instant analyst, gaining efficiencies with automation in day-to-day reporting processes as well as improving overall decision-making with reliable data,” – Kelly King, CFO, WaterStreet Company.

How can I track how my business is growing under certain products?

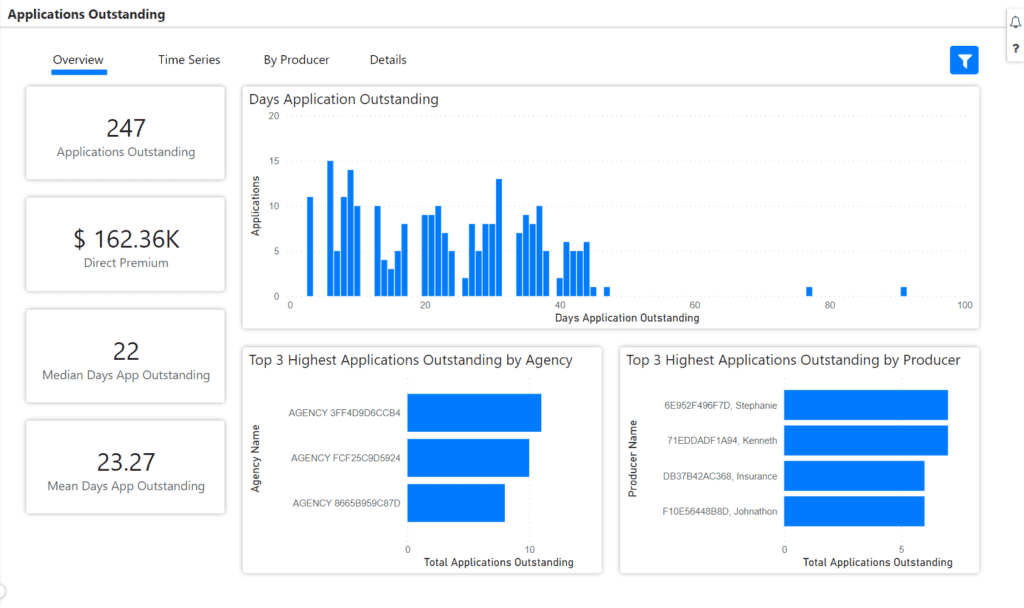

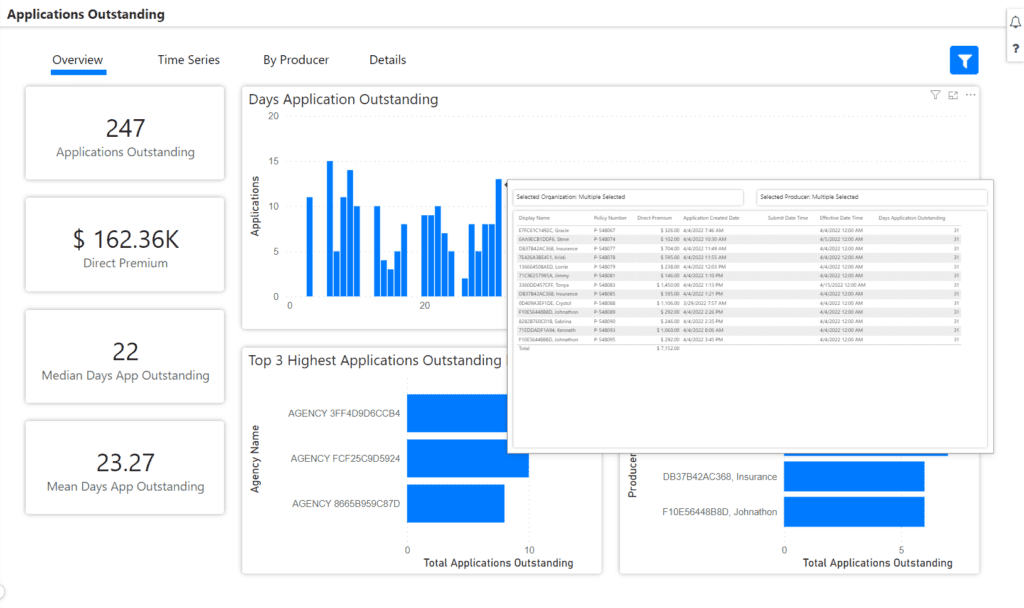

The Applications Outstanding dashboard report helps to identify the average cycle time for an application to go from creation to binding and issuing. Operations managers can see signs of process efficiencies or inefficiencies during a cycle of time.

Operations managers may also see a sudden increase or decrease in applications outstanding that may alert the team to a problem with the product or the process that needs to be addressed. It could alert the manager to increasing or decreasing staff to handle volume or it could alert the manager to a potential problem with “action items” on 3rd party data.

Analytically, it is good for operation managers to have a strong sense of trends – weekly, monthly, and annually. Tracking new products or major changes in products within Applications Outstanding will reveal how well those changes were received by the agent and the prospects for insurance.

What information should I communicate with agents to inform them of areas of the business we’d like to promote?

This report may tell you which agents have caught on to new products or product changes and which may have not. Reviewed at the agent level, it could be useful in your marketing department’s approach to agents.

How can I tell when a customer has given up on pursuing an application?

Operations managers or customer service managers may note applications that have aged without being bound. These managers can identify when action items have not been fulfilled or approved. This could mean the prospect found insurance elsewhere or the closing date could have been moved. Overall, reviewing Applications Outstanding can help to identify which applications need attention.

WaterStreet Company & Applications Outstanding

WaterStreet Company aims to deliver best-in-class solutions for P&C insurers. This year, we’ve launched our Business Intelligence Suite to help insurers track vital key performance indicators specific to the insurance industry.

We provide advanced P&C Insurance Software designed to grow with your business, allowing integration with next-generation solutions.

Ready to Take Action?

Reach out to WaterStreet Company today to request a consultation and demo of our solutions.