When an application is bound outstanding, the policyholder has been bound to a policy but payment is outstanding. New underwriting rules and rates must be communicated to agencies, and all policies bound outstanding must be caught at the right time to ensure the policyholder’s existing rate is honored.

Underwriters, customer service managers and operations managers have reason to review applications bound outstanding. Periodic review of bound outstanding policies can uncover bottlenecks in the policy administration process.

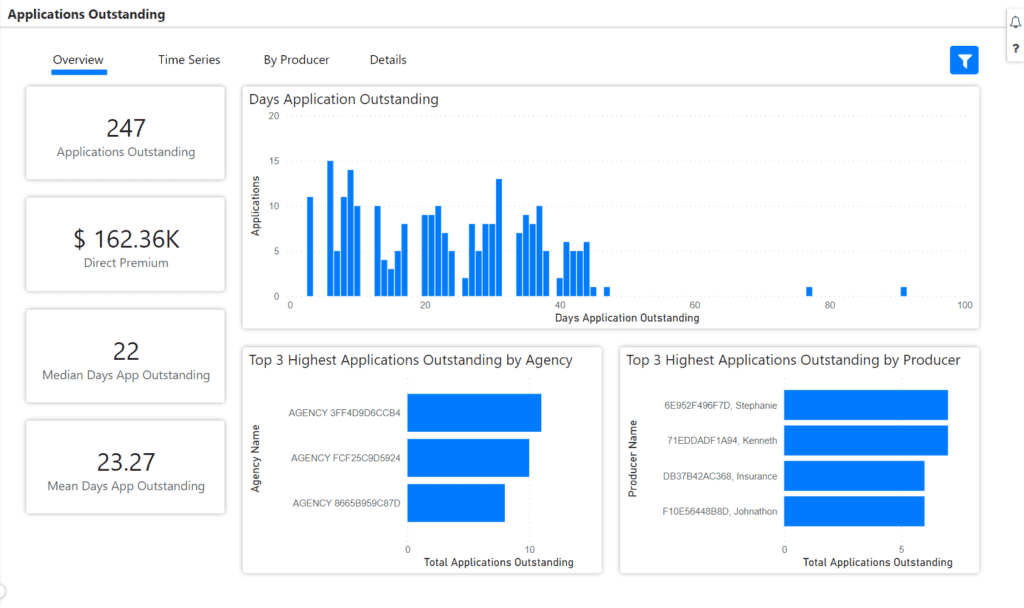

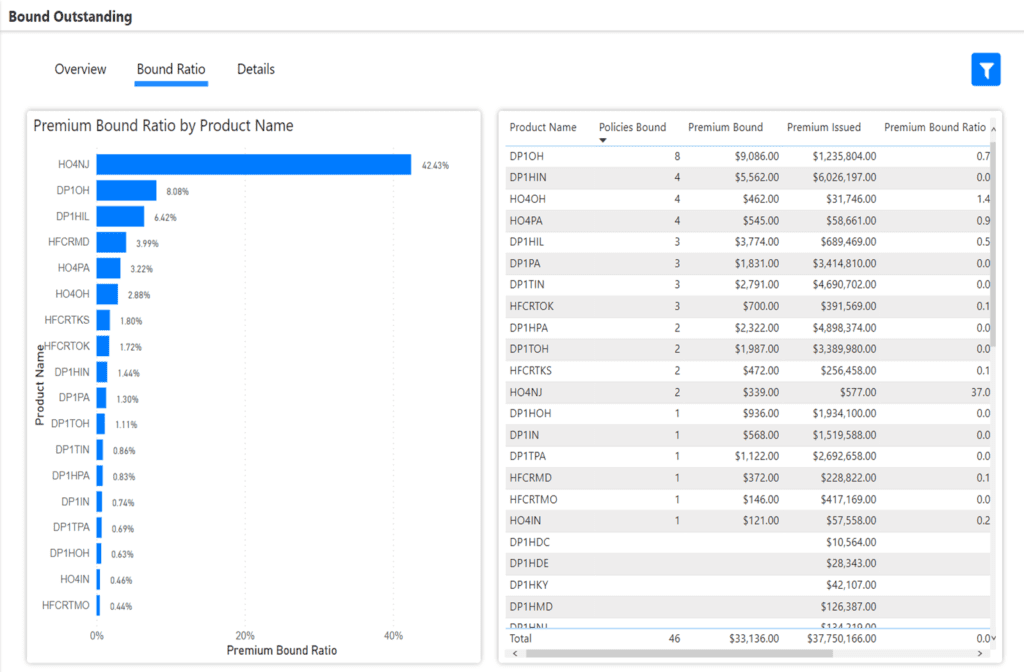

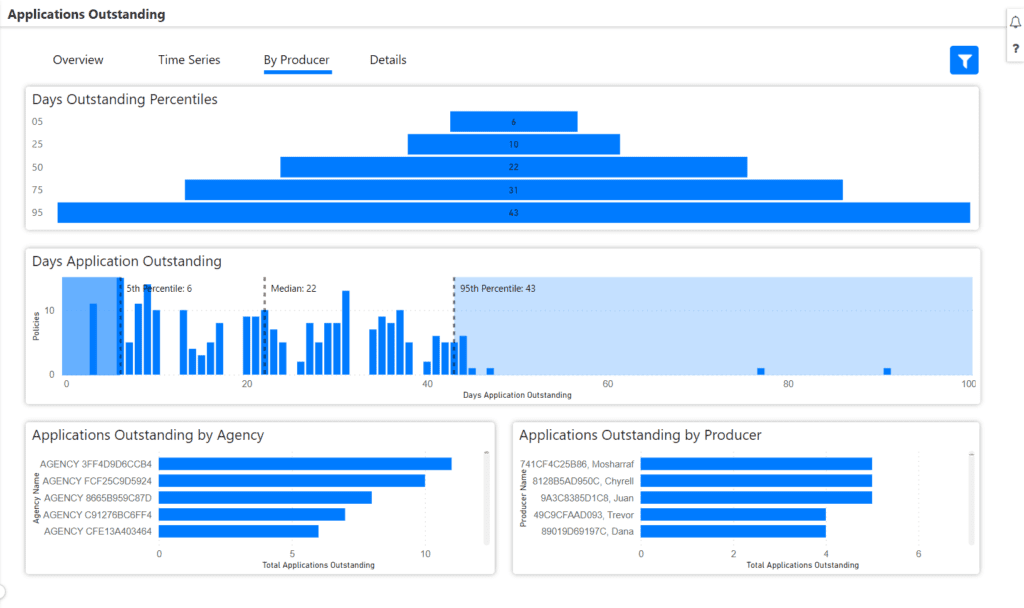

WaterStreet Company makes it easy to review applications bound outstanding with our Business Intelligence Suite, including:

- Find what policies have already been promised by effective date as they were quoted when changing underwriting rules or rates.

- Identify bound policies with how many days are bound outstanding for next steps in the policy administration system.

- Count the frequency of quoting.

- Review processing expectations to answer critical questions:

- Does the effective date need to be reached prior to issuance?

- Does payment have to be received prior to issuance?

- Has any data or rules changed since the risk was bound that needs to be addressed?

- Provide agencies with a list of policies to assist with reassigning active producers to existing business.

Bound Outstanding Analytics

“With WaterStreet’s Business Intelligence Suite, every user becomes an instant analyst, gaining efficiencies with automation in day-to-day reporting processes as well as improving overall decision-making with reliable data,” – Kelly King, CFO, WaterStreet Company.

When changing underwriting rules and rates, how should insurers approach applications bound outstanding?

It’s important to determine the reason why a policy remains in the “bound” status. This starts by determining the KPI on getting a policy from bound to issuance status. Identify if there are still action items remaining, if the policy administration team is waiting on documents to be received or reviewed prior to issuing, or if the delay is because the insurer has not received payment.

It’s also important to observe what is in the pipeline and will be recognized as a written premium once the policy is issued. There may be a preponderance of outstanding bound policies with a particular agency or with outstanding bound policies within a particular territory.

Changing the rules usually does not impact policies already in bound status as those were promises of insurance at existing rates and rules that should be honored. Quotes may still be altered to fit new rules or guidelines, and those changes should be planned and communicated to the agents when implemented.

How can agencies help with applications bound outstanding?

Agencies can help when policy is “stuck” in bound status. Agencies can review in their systems what is holding up applications bound outstanding, such as documents needed or payment needed.

WaterStreet Company & Bound Outstanding Analytics

WaterStreet Company aims to deliver best-in-class solutions for P&C insurers. This year, we’ve launched our Business Intelligence Suite to help insurers track vital key performance indicators specific to the insurance industry.

We provide advanced P&C Insurance Software designed to grow with your business, allowing integration with next-generation solutions.

Ready to Take Action?

Reach out to WaterStreet Company today to request a consultation and demo of our solutions.