Strike rate is a common term used across many sports as well as in P&C insurance. This rating is used to score agents and brokers to help an insurer determine value brought to their business.

Executives, underwriters, customer service managers, operations managers, marketing managers and product managers have interest in reviewing strike rate to help inform various areas of the policy administration process.

WaterStreet Company makes it easy to review and compare key information about strike rate with our Business Intelligence Suite, including:

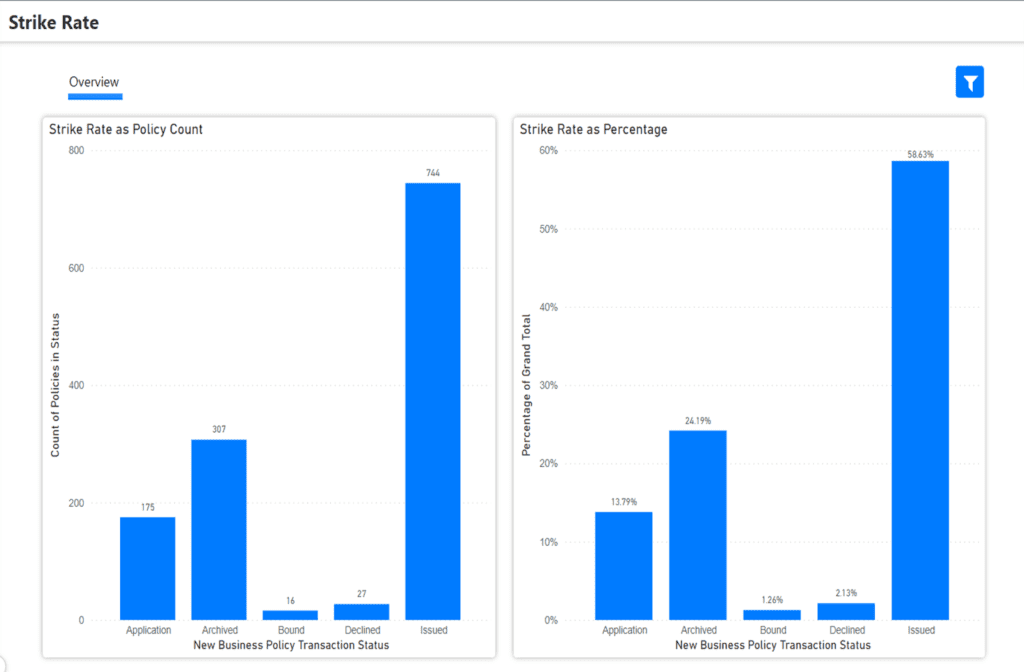

- Compare counts and percentages of transaction statuses, including policies bound, issued, declined and lost, by timeframe.

- Determine the effectiveness of your new business efforts by measuring counts and percentages of various transaction statuses.

- Filter by agency level to dive deeper into the cause of high strike rates.

- Understand key factors behind the underwriting acceptance rate.

- When a target strike rate for closed business is established, evaluating strike rate by broker is a particularly powerful measure of their performance.

Strike Rate Analytics

“With WaterStreet’s Business Intelligence Suite, every user becomes an instant analyst, gaining efficiencies with automation in day-to-day reporting processes as well as improving overall decision-making with reliable data,” – Kelly King, CFO, WaterStreet Company.

What is “strike rate” in P&C insurance?

Strike Rate measures the quality of new business that agents or brokers bring to the company and reflects the underwriting acceptance rate. The strike rate is measured across five key metrics for a determination of quality over quantity. This rate measures how much is being lost vs how much is being closed for new business.

Why is strike rate important when evaluating brokers?

All producers generate quotes while some generate tons of quotes from various sources, more like a “shotgun” approach. These producers with high quote generation may get a relatively low strike rate of policies issued and accepted by the insurer.

Other producers are very targeted as they may only quote a carrier if they think it has a high probability to be accepted and written. Good executives, especially the marketing experts, should know what to expect from the different kinds of producers and then manage them accordingly.

How can I take steps to improve the strike rate?

Improving strike rate may or may not be a goal, depending on if the producers are delivering expected results. Low strike rates may mean your prices are too high compared to your competitors or your underwriting rules and guidelines may be too strict. Another interpretation could be that your underwriters may be too tightly interpreting guidelines.

WaterStreet Company & Strike Rate Analytics

WaterStreet Company aims to deliver best-in-class solutions for P&C insurers. This year, we’ve launched our Business Intelligence Suite to help insurers track vital key performance indicators specific to the insurance industry.

We provide advanced P&C Insurance Software designed to grow with your business, allowing integration with next-generation solutions.

Ready to Take Action?

Reach out to WaterStreet Company today to request a consultation and demo of our solutions.