The age of a home’s roof can play a major role in underwriting and product development for aging homes. This area of homeowners insurance often incurs high costs for roof repair and replacement, and insurers may compare similarly aged homes to help reduce these costs among others. Roofs are prone to damage by perils, such as hail, wind and storm damage, and can come with a wide range of associated costs.

Underwriters, actuaries and product managers may be interested in reviewing the characteristics of aging homes, and especially aging roofs. Roofs that are over 20 years are likely to set off alarm bells, requiring inspection to renew the policy.

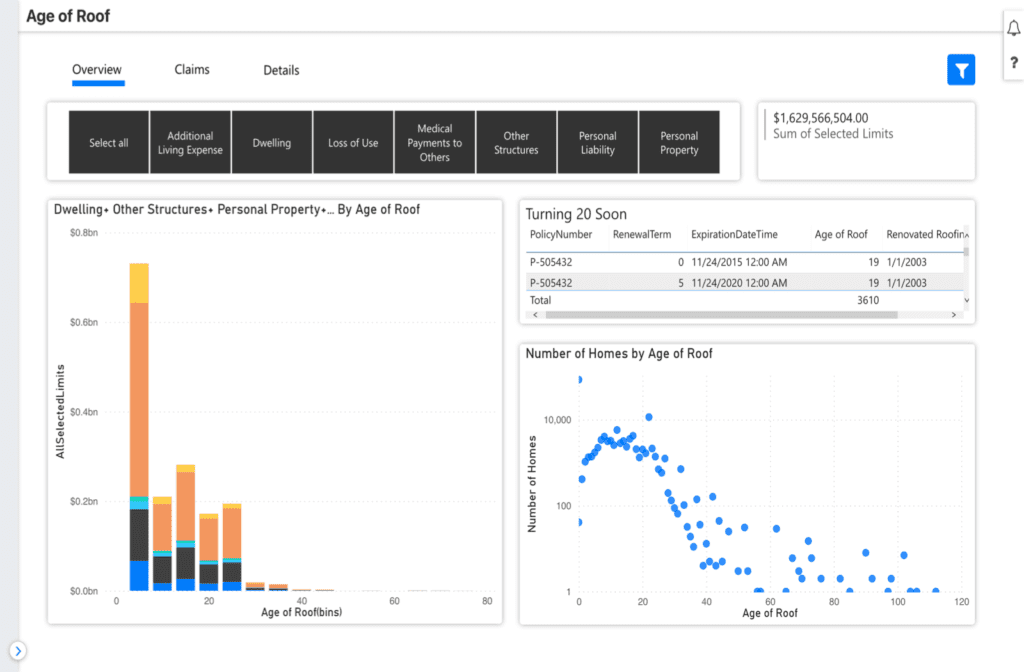

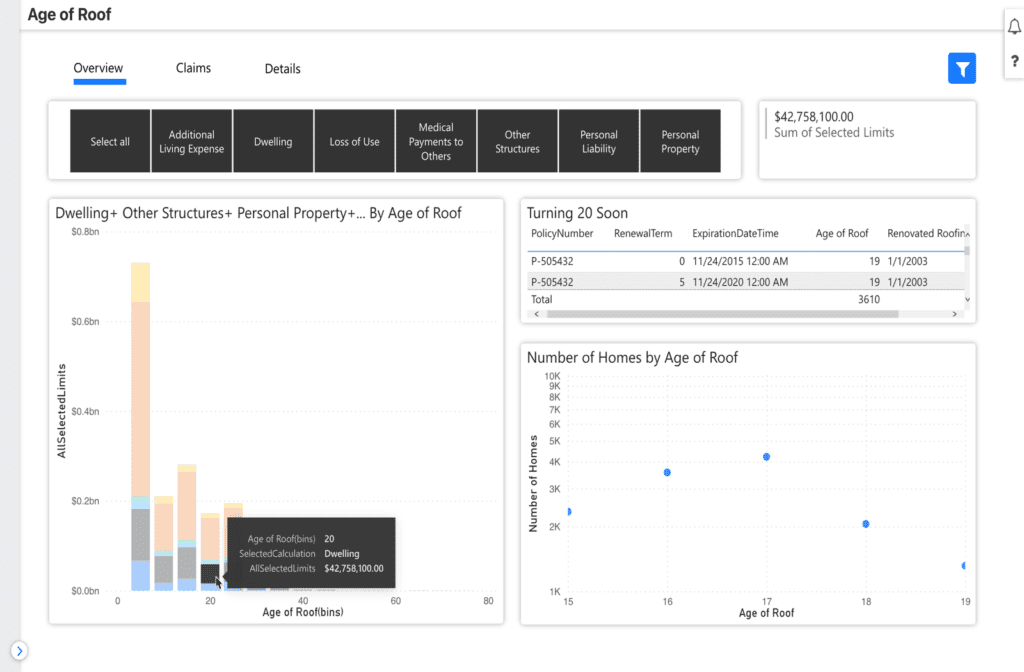

WaterStreet Company makes it easy to review and compare key information about aging roofs with our Business Intelligence Suite, including:

- Analyze exposure by the feature “Age of Home.”

- Find relationships and trends in profitability of similar aging homes.

- Order inspections for aging homes.

- Adjust replacement costs for aging roofs.

- Manage risk exposure by better predicting when roofs may need to be replaced.

- Access a “Turning 20 Soon” table with customization to identify the aging homes with roofs most at risk.

Age of Roof Analytics

“With WaterStreet’s Business Intelligence Suite, every user becomes an instant analyst, gaining efficiencies with automation in day-to-day reporting processes as well as improving overall decision-making with reliable data.” – Kelly King, CFO, WaterStreet Company

Why does age of home and roof matter when underwriting?

Underwriters, actuaries and product managers are able to view policies by age of home and age of roof with our Business Intelligence Suite. The Age of Roof is meaningful in terms of comparing the useful life of any roof type. It’s important to note that the older the roof, the more vulnerable to damage, and the more depreciated the roof is when considering “actual cash value” vs. the “replacement cost” of the roof.

Age of Home is another key characteristic that matters for weather-related factors as well as all forms of disrepair and poor maintenance, including deterioration that may not be sudden and accidental. Major home systems, such as plumbing and electrical, become more vulnerable to damage and loss as they age. Materials also may have evolved since first installed, driving insurers to dive deeper into the age of the home.

What trends should I pay attention to when reviewing the age of a home?

A key trend to watch when reviewing the age of homes and age of roofs is the effective dates of Building Code enhancements. When new compliance for better standards affects a home, enforcing these codes reduces the risk for loss.

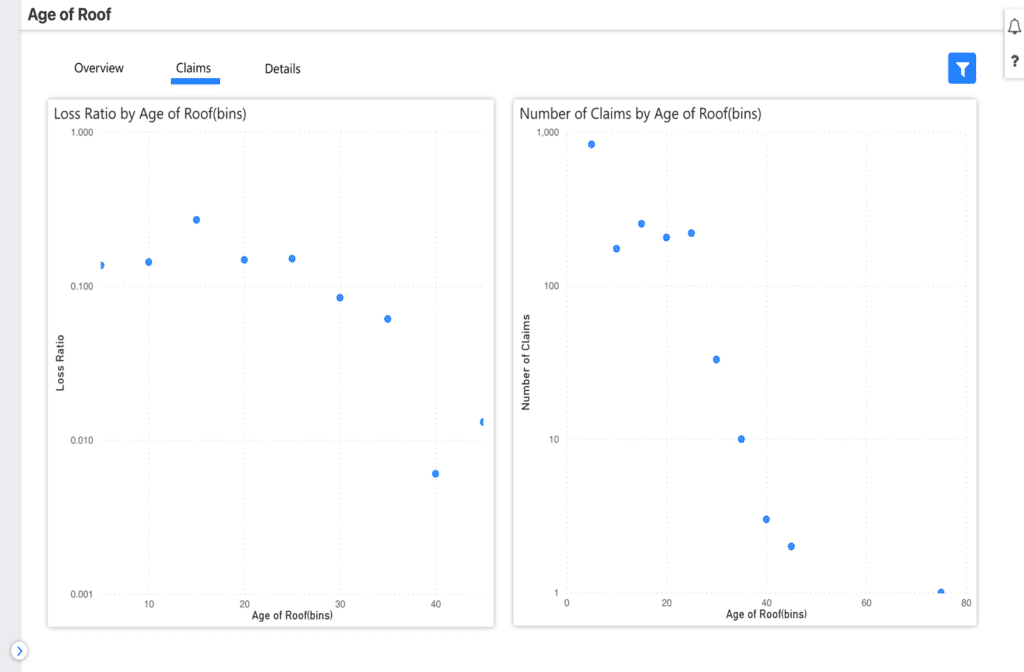

Can I compare claims submitted for homes that are similar to the home I am underwriting?

Yes, users should most certainly compare policies of interest against claims reported, claims types reported, and more. There are a number of key underwriting characteristics beyond age of roof or age of home that can be drilled down when comparing against claims. This analysis could lead to potential changes in premium rates and underwriting selection.

WaterStreet Company & Aging Homes

WaterStreet Company aims to deliver best-in-class solutions for P&C insurers. This year, we’ve launched our Business Intelligence Suite to help insurers track vital key performance indicators specific to the insurance industry.

We provide advanced P&C Insurance Software designed to grow with your business, allowing integration with next-generation solutions.

Ready to Take Action?

Reach out to WaterStreet Company today to request a consultation and demo of our solutions.